A subsidiary or joint venture can take either one of the following two corporate forms recognized under the Japanese law: a Joint Stock Company (Kabushiki-Kaisha) or a Membership Company (Mochibun-Kaisha) that includes General Partnership Company (Gomei-Kaisha), Limited Partnership Company (Goshi-Kaisha), Limited Liability Company (LLC,Godo-Kaisha).

The major difference between these corporate forms is based on how and to what extent a shareholder or partner is liable for the company’s debts and obligations, or whether investment and management is from the same source or not.

Joint Stock Company

The Joint Stock Company (Kabushiki Kaisha, or KK) is the most widely used form in Japan. It is also used by foreign investors for a wholly owned subsidiary or joint venture with Japanese partners. It consists of a large number of shareholders whose liabilities are limited to the capital invested. The incorporation procedure and management, accounting, and auditing requirements of a joint stock company are provided in detail under the Companies Act. In general, a joint stock company has greater advantages in business than other forms. For example, a joint stock company enjoys financial and business credibility and a better public image.

Establishment of a joint stock company used to have a minimum capital requirement of ¥10 million, but the regulation changed which made it possible to establish a company with any amount of capital.

A company can be incorporated in Japan by non-resident of Japan alone.

Membership Company

The Membership Company (Mochibun-Kaisha) includes following three forms, General Partnership Company (Gomei-Kaisha), Limited Partnership Company (Goshi-Kaisha), Limited Liability Company (Godo-Kaisha: GK).

While the management of joint stock companies is definitely detached from the investors, membership companies have the characteristics that the investors are also directors who carry out operation, that is to say, investment and management is from the same source.

The merit of these types of companies is that they are established by investors at the same time directors who enjoy mutual trust, thus they are good for small business.

General Partnership Company (Gomei-Kaisha) and Limited Partnership Company (Goshi-Kaisha) exist in the old Commercial Act. They enjoy the merits of internal self-governing and simple formalities when established. But because of the unlimited liabilities of directors, few of them exist at present.

On the other hand, Limited Liability Company (Godo-Kaisha) is an organization form, which makes up the disadvantage of Gomei-Kaisha and Goshi-Kaisha, keeping the merits of Membership Company and allowing the limited liabilities of directors.

Difference between Joint Stock Companies (KK) and Godo Kaisha GK

| Form | KK | GK(Godo Kaisha) |

|---|---|---|

| Investors | Stock holders | Directors with limited liabilities |

| Indispensable board | Stockholders' meeting, Directors | Board of directors, Directors |

| Business operator | Managing director etc. | Executive employee |

| Minimum capital requirement | 1 JPY | 1 JPY |

| Change in articles of incorporation | Special resolution in stockholders' meeting | Agreement from all directors |

Registration

A foreign investor may set up a branch of a foreign company to engage in any commercial activities in Japan by filing a notification with the government office under the Foreign Exchange and Foreign Trade Law. To conduct business in Japan, a branch must also be registered under the Commercial Registration Law. Although a branch operation is acceptable in any business category, it is considered most suitable for purchase, sales and service operations. A branch of a foreign company must be established in compliance with the legal requirements of the Companies Act. Under the Act, a foreign company continually engaging in commercial transactions in Japan must appoint a representative in Japan (branch manager), set up a place of business and register with the local registry office of the Legal Affairs Bureau of the Ministry of Justice. The registered representative is authorized under Japanese law to perform all acts on behalf of the branch. If the branch manager changes, that change must be registered.

Conversion to a subsidiary

Converting a branch to subsidiary is legally possible, but requires careful consideration. It is a rather time-consuming and costly process. The foreign corporation may set up a subsidiary and then transfer the branch’s assets to the subsidiary. If a foreign investor plans to conduct business in Japan over a long period, setting up a subsidiary at the outset may be more desirable.

A representative office is not a legal entity and is not required to obtain commercial registration. Consequently, foreign investors can generally open a representative office without filing any report with government ministries. (The opening of an office of a foreign bank, foreign securities company or foreign insurance company, however, requires notification to the Ministry of Finance.) The only document required for its establishment is a notification to the relevant tax office in the case of the establishment of an office employing salaried workers. Also joining social insurance may be required in the case of employing salaried workers.

Because of its lack of legal status, a representative office is not allowed to engage in any commercial transactions nor set up a bank account. Its activities are limited solely to purchasing or storing items and other liaison activity like gathering information, market research and publicity etc. for the head office of a foreign corporation; a representative office is not subject to Japanese corporate tax for its liaison activities on behalf of a foreign corporation. If its performance was beyond those permitted, however, a representative office could become a taxable entity.

A representative office can bring in funds as operating expenses without restriction. The restrictions imposed on the activities of a representative office make that status generally suitable only for temporary operations for a foreign investor who intends to establish a branch or subsidiary in the near future. Therefore this approach is often used by a foreign investor who requires a great big deal of market research before developing a legally recognized branch operation.

The tax authorities may review the activities of the representative office to determine whether they are merely auxiliary or preparatory. If they were recognized as business activities, the Japan source income would be subject to Japanese corporate income tax.

The main differences in the tax treatment between Japanese branches and Japanese subsidiaries are as follows.

Accounting for payments made on behalf of parent or headquarter

Expense incurred by the head office for the benefit of a Japanese branch may be allocated to the Japanese branch and deducted by the Japanese branch on its Japanese tax return.

In case of company (subsidiary), a subsidiary can account expenses paid to its parent company as management fee or royalty based on a contract between the subsidiary and the parent.

Dividends

Dividends paid by a Japanese subsidiary to a foreign shareholder are subject to Japanese withholding tax while remittance of branch profits after tax to its head office in a foreign country is not subject to Japanese withholding tax.

Interest or royalty

Interest or royalty paid by a Japanese subsidiary to a foreign corporation is deductible for the Japanese subsidiary unless it is excessive, although it is subject to Japanese withholding tax.

On the other hand, interest or royalty paid by a Japanese branch to the foreign head office is not tax deductible.

However, if it can be demonstrated that the head office has paid interest on a loan or royalty for industrial property, etc. that is utilized in the Japan branch’s operation, such interest or royalty may be deducted by the Japanese branch although such interest or royalty is subject to Japanese withholding tax.

Legal Status

Under the Japanese law, the branch does not have its own legal status, but is treated as a part of the legal status of the foreign corporation. In other words, branch is not a Japanese company but it is a part of foreign company. Therefore, in general, the responsibility for claims and debts arising from the activities of the branch will ultimately belong directly to the foreign company. If you would like to avoid such risks of Head office, setting up subsidiary company in Japan is one of the solution.| Branch | Company (subsidiary) | |

|---|---|---|

| Accounting for expenses | Possible if not excessive | Possible if not excessive |

| Dividends | Remittance of after-tax profit not subject to Japanese withholding tax | Subject to Japanese withholding tax |

| Interest or royalty | Not tax deductible in principle | Tax deductible, subject to withholding tax |

| Attribution of responsibility | Branch and overseas company(Head office) | Company (subsidiary) |

Regarding taxation on income earned by Japan branch of a foreign company, “Attributable income principle” based on OECD model tax treaty is applied.

The “Attributable income principle” dictates that income attributable to a branch should be the amount that could be earned by the branch if it were a separate and independent entity, and only such income should be taxable in Japan. In ‘’ Attributable income principle’’, transaction with third party , assets, risk should be attributed to the branch, based on function and fact made by the branch. And intercompany transactions between the head office and the branch office is recognized as a transaction done by arms-length price.

However, the tax authorities might not challenge an arrangement where a legally separate entity in Japan provides service to other legally separate foreign corporation(s) for a reasonable service fee determined under a written agreement (e.g., a service fee may range from 105% to 110% of the expenses incurred for the said services).

When a Japanese subsidiary of a foreign parent company uses this scheme and charges a service fee to the parent company, the transaction will be exempt from consumption tax (zero-rated supply) and as a result the subsidiary may be able to reclaim consumption tax paid on purchases (input tax).

However, this may not apply to a Japanese branch of a foreign company because such transaction may be considered as an internal transaction, not as an export of service.

Please note that each report in the following table can be applied to either companies or branches unless otherwise stated separately..

Reporting for tax purposes is required after company establishment or opening branch for legal purposes. Following is a list of documents to be filed with the tax offices.

| National Tax Office (See *1) | Documents necessary | Filing due |

|---|---|---|

| 1. Report on establishment of company (Domestic corporation) | Copy of articles of incorporation |

Within 2 months after establishment |

| 2. Report on establishment of a foreign corporation (Foreign corporation) | Copy of articles of incorporation in Japanese |

Within 2 months after commencement |

| 3. Application for approval of filing a blue tax return | None | Within 3 months after establishment or the first fiscal year-end, whichever is earlier |

| 4. Application for extension of corporate tax return filing due date—if necessary (See*2) | None | The end of the fiscal year |

| 5. Report on commencement of payroll payment | None | Within 1 month after paying salary |

| 6. Application for approval of paying withholding tax by every July 10 and January 10 | None | Any time if the number of employees is less than 10 |

| 7. Report on method of depreciation to be used | None | When first tax return is due |

| 8. Report on method of evaluation of inventory assets | None | Same as 7 above |

| Local Tax Office(See *3) | Documents necessary | |

| 9. Report on establishment of company or branch | Copy of Articles of Incorporation (AOI) and Copy of registry | Within 15 days after starting business (See *3) |

| 10. Application for extension of enterprise and inhabitant tax return filing due date—if necessary | None | Same as 4 above |

*1 In addition report on consumption tax may be necessary.

*2 A company ,which applies to the application of extension of corporate tax return filing due, can also apply for extension of filing due regarding consumption tax return.

*3 Required for both prefectural tax and municipal tax.

*4 It depends on autonomy; could be within one month after starting business.

The accounting period for corporation tax purposes is the accounting period provided on the Articles of Incorporation of the corporation. However, the period must not exceed 12 months. The Japan branch of a foreign corporation must use the same accounting period as the head office. Many Japanese corporations generally decide their accounting period from April 1st to March 31st,but the company can choose any accounting period.

Accounting for tax purposes follows, in principle, accounting principles generally accepted in Japan. An appropriately determined accounting standard must be consistently applied.

There is generally no significant difference between the pre-tax income for accounting purposes and the taxable income for corporate income tax purposes. However, in order to determine income for corporate tax purposes, certain adjustments must be made to the pre-tax accounting income.

For example, if expenses such as for entertainment, depreciation, donation and executive remuneration exceed tax limits, they would be added to taxable income.

A corporation must file tax return and pay the tax within two months after the end of its fiscal year. One month extension would be permitted for Japanese companies, if the application is submitted by the due. A few more month extension may be possible for foreign corporations.

Except for newly established corporations, if the fiscal year is longer than six months, the corporation must file an interim return within two months of the end of the first six months and make an advance payment at the time of filing the interim return of either 50% of its prior year’s tax liability or 100% of its estimated tax liability for the first six months of the current year.

There is a “Blue form Return” system in order to encourage taxpayers to declare taxable income based upon accurate accounting records.

This system provides special benefits such as taking special depreciation, establishment of certain reserves, carry forward of tax losses*, carry back of tax losses and claiming tax credits under the Special Taxation Measures Law. In addition, a tax examination is conducted based upon the taxpayer's books of account.

All types of taxpayers (including foreign corporations) may apply for permission to use a blue form return. To be permitted, the taxpayer must satisfy certain requirements such as keeping proper accounting books. But once it is approved and as long as the accounting system is in order, the taxpayer can usually receive special benefits above.

For a new corporation or a new Japan branch, an application must be submitted within 3 months of the date of establishment or the last day of the first accounting period, whichever comes first.

* * The expiry period for loss carry forward is 10 years. Maximum amount of deduction is 100% of income for small and medium sized enterprises. For large companies, it is 50%.

The taxable income for corporation tax purposes is calculated based on the pre-tax income of the income statement of the corporation with needful adjustments.

Corporation tax is calculated by applying the corporation tax rate to the annual taxable income.

Certain tax credits, if applicable, are deducted from the computed corporation tax.

| Annual taxable income | Capital 100millions or less | Capital more than100 millions (*3) | |

| Corporation applicable for reduced tax rate | Corporation not applicable for reduced tax rate(*2) | ||

| Annual taxable income8 million or less | 15.00% (*1) | 19% | 23.20% |

| Annual taxable income more than 8 millions | 23.20% | 23.2% | |

(*1) The reduced tax rates for taxable income for fiscal years beginning before 31st March 2027 (the original tax rate is 19%). However, 17 % will be applied if annual income exceeds 1 billion yen.

(*2) Corporation with average annual income over 3 preceding financial years exceeding 1.5 billion yen

(*3) A subsidiary whose parent company’s or ultimate parent company’s capital is 500 million yen or more is included here even if the subsidiary’s own capital is 100 million or less.

(*4) In addition to the above (national) corporation tax, local corporation tax will be charged at 10.3% of the amount of the (national) corporation tax.

Local inhabitants’ tax (i.e., prefectural tax and municipal tax) consists of the tax based on the corporate income tax liability plus per capita tax.

The per capita tax is determined based on the paid-in capital (including capital surplus) and the number of employees.

The tax based on the corporation tax liability is calculated by applying prefectural tax rates and municipal tax rates to the amount of the corporate income tax allocated each to the prefecture and municipality based on the number of employees.

| The capital amount | The number of employees of the local office | Prefectural tax+Municipal tax | ||

|---|---|---|---|---|

| Standard tax rate | Tokyo | Osaka | ||

| Above 5000M | Above 50 | 3,800,000 | 3,800,000 | 4,600,000 |

| 50&below | 1,210,000 | 1,210,000 | 2,010,000 | |

| Above 1000M 5000M&below |

Above 50 | 2,290,000 | 2,290,000 | 2,830,000 |

| 50&below | 950,000 | 950,000 | 1,490,000 | |

| Above100M 1000M&below |

Above 50 | 530,000 | 530,000 | 660,000 |

| 50&below | 290,000 | 290,000 | 420,000 | |

| Above10M 100M&below |

Above 50 | 200,000 | 200,000 | 225,000 |

| 50&below | 180,000 | 180,000 | 205,000 | |

| 10M&below | Above 50 | 140,000 | 140,000 | 140,000 |

| 50&below | 70,000 | 70,000 | 70,000 | |

Applicable tax rate is determined by the regulation of local public body.

(The applicable tax rate may be higher than the standard tax rate)

| Municipal tax* | Prefectural tax | |

|---|---|---|

| Any corporation | 6% | 1% |

(Note1)

Applicable tax rate is determined by the regulation of local public body.

(The applicable tax rate may be higher than the standard tax rate)

(Note2)

Regarding a company with paid-in capital over JPY100,000,000, higher tax rate higher than standard is applied.

Corporations are also subject to prefectural enterprise tax.

Net taxable income for enterprise tax purposes is not necessarily the same as that for corporation tax purposes.

For example, for enterprise tax purposes, foreign source net business income earned through a fixed facility of business abroad is excluded from taxable income.

Also, the reserve for losses from overseas investments and the special deduction for certain overseas technical service transactions provided for in the Special Taxation Measures Law are not available.

The enterprise tax rate depends on the amount of taxable income allocated to each prefecture and is determined by each prefecture.

a)Company with capital of over 100M

| Added value levy | Capital levy | Income levy |

|---|---|---|

| 1.2% | 0.5% | 1.0% |

| 260% of base income tax levy(*3) |

b)Company with capital of 100M or less

| Annual income threshold | Income levy | |

|---|---|---|

| Reduced Tax rate | Up to 400M | 3.5% |

| Over 4M up to 8M | 5.3% | |

| Over 8M | 7.0% | |

| Proportional tax(*2) | 7.0% | |

| 37% of base income tax levy (*3) |

*1. The rate in the above table is standard tax rate. Each prefecture determines the applicable tax rate which is limited to the maximum rate of 1.2 times of the standard tax rate.

*2. Proportional tax rate shall be imposed on a company which has offices in more than 3 prefectures and a capital of 10M or more.

*3. base income levy amount means the income levy tax amount which calculated by standard tax rate.

The effective tax rate including corporation tax, local corporation tax, residential corporation tax, enterprise tax and special local corporation tax is as follows;

| FY beginning on or after 1st April 2022 | ||

|---|---|---|

| Capital more than 100 million yen* | 29.74% | |

| Capital at or below 100 million yen | Annual income at or below 4 million yen | 25.89% |

| Annual income between above 4 million and at or below 8 million | 27.57% | |

| More than 8 million | 33.58% | |

* Note: A subsidiary whose parent company’s or ultimate parent company’s capital is 500 million yen or more is included here even if the subsidiary’s own capital is 100 million or less.

Tangible assets used for business (e.g. buildings, building improvements, structures, tools, and motor vehicles) and intangible assets such as software generally lose their value as time passes. These types of assets are called depreciable assets. On the other hand, assets that do not lose value such as land or antiques are not subject to depreciation.

The acquisition cost for depreciable assets shall be allocated periodically over the usable period instead of being expensed at the time of acquisition. A number of usable years are designated by law for each type of asset.

There are two types of depreciation method, the “straight-line method” and the “declining-balance method”. A company has to report to the tax office which method will be used for each asset. If it’s not reported, the declining-balance method shall be applied. Building and intangible asset which is obtained after April 1st 1998,equipment affixed to buildings(建物付属設備) and Structure(構築物) which is obtained after April 1st 2016 must be depreciated by the straight-line method.

The table below explains the details.

| Formula | |

|---|---|

| Straight-line method | Acquisition value × depreciation rate |

| Declining-balance method | Un-depreciated cost at the beginning of the fiscal year × depreciation rate(*2). Once the depreciated cost falls below the insured amount(*3), the formula “revised acquisition value(*4) × revised depreciation rate(*5)”shall be used instead. |

(*1) Different depreciation rates are applied for assets acquired after April 1, 2012 and assets acquired before that date.

(*2) Different depreciation rates are applied to asset acquired after 1st April 2012 and asset acquired before 1st April 2012.

(*3) Acquisition cost × a specific rate according to the number of usable years.

(*4) Un-depreciated cost of the first year that the original depreciation cost falls below the insured amount.

(*5) The rate depends the usable period of the asset such that the same depreciation cost would be applied in the future.

If the tangible asset was acquired in the middle of the fiscal year, the number of months of actual use is subject to depreciation. For certain tangible assets, the special depreciation shall be applied according to the Act on Special Measures Concerning Taxation.

Japan Tax Law defines a number of usable years depending on asset type, structure, and purposes of use. If usable years an asset is not used for more than one year or costs more than ¥100,000, it can be expensed in the year of acquisition.

| Number of Usable Years |

Straight-line method | Declining-balance method | Usable Years | Straight-line method | Declining-line method | ||||

|---|---|---|---|---|---|---|---|---|---|

| Rate | Revise d rate | Insured rate | Rate | Revised rate | Insured rate | ||||

| 2 | 0.500 | 1.000 | - | - | 18 | 0.056 | 0.111 | 0.112 | 0.03884 |

| 3 | 0.334 | 0.667 | 1.000 | 0.11089 | 19 | 0.053 | 0.105 | 0.112 | 0.03693 |

| 4 | 0.250 | 0.500 | 1.000 | 0.12499 | 20 | 0.050 | 0.100 | 0.112 | 0.03486 |

| 5 | 0.200 | 0.400 | 0.500 | 0.10800 | 21 | 0.048 | 0.095 | 0.100 | 0.03335 |

| 6 | 0.167 | 0.333 | 0.334 | 0.09911 | 22 | 0.046 | 0.091 | 0.100 | 0.03182 |

| 7 | 0.143 | 0.286 | 0.334 | 0.08680 | 23 | 0.044 | 0.087 | 0.091 | 0.03052 |

| 8 | 0.125 | 0.250 | 0.334 | 0.07907 | 24 | 0.042 | 0.083 | 0.084 | 0.02969 |

| 9 | 0.112 | 0.222 | 0.250 | 0.07126 | 25 | 0.040 | 0.080 | 0.084 | 0.02841 |

| 10 | 0.100 | 0.200 | 0.250 | 0.06552 | 26 | 0.039 | 0.077 | 0.084 | 0.02716 |

| 11 | 0.091 | 0.182 | 0.200 | 0.05992 | 27 | 0.038 | 0.074 | 0.077 | 0.02624 |

| 12 | 0.084 | 0.167 | 0.200 | 0.05566 | 28 | 0.036 | 0.071 | 0.072 | 0.002568 |

| 13 | 0.077 | 0.154 | 0.167 | 0.05180 | 29 | 0.035 | 0.069 | 0.072 | 0.02463 |

| 14 | 0.072 | 0.143 | 0.167 | 0.04854 | 30 | 0.034 | 0.067 | 0.072 | 0.02366 |

| 15 | 0.067 | 0.133 | 0.143 | 0.04565 | 40 | 0.025 | 0.050 | 0.053 | 0.01791 |

| 16 | 0.063 | 0.125 | 0.143 | 0.04294 | 50 | 0.020 | 0.040 | 0.042 | 0.01440 |

| 17 | 0.059 | 0.118 | 0.125 | 0.04038 | |||||

Small business (Consolidated company, fiscal year in which the number of regular employees exceeds more than 500. Also, fiscal year in which annual average income over 3 preceding years exceeds 1.5 billion yen will be excluded.), that use the “Blue form Return” system and acquired depreciable assets (*) amounting less than 300,000 yen can depreciate 100% of acquisition cost in the fiscal year of acquisition. The maximum total amount of small sum depreciable asset each year is 3 million yen.

In the case of assets over 100,000 yen and less than 200,000 yen, the depreciation expenses can be allocated equally over 3 years with no scrap value.

(*)Assets for leases are likely to be excluded unless leasing is a major part of the business. (When this will come into force is yet to be determined.)

Under the Corporation Tax Law, the tax-deductibility of entertainment expenses and donation is limited.

1) The entertainment expenses of a company whose capital at the end of the business year does not exceed ¥100M will be deductible up to ¥8M. Over 8M will not be deductible.

2) Except company with paid-in capital over JPY10,000,000,000, eating cost will be deductible up to 50% of its total amount.

(Therefore, small and middle-size companies can select 1) or 2) whichever is favorable.)

Economic profit given free of charge by a corporation to public welfare organization or other facility, which do not directly benefit the business of the corporation, is regarded as donations for tax purpose.

The allowance of deductible donations is generally limited to the sum of 0.625% of taxable income (before deduction of donations) plus 0.0625% of paid-in capital and capital surplus of the corporation.

The paid-in capital of a Japan branch of a foreign corporation, which is applied in calculation of the limit of tax deductible entertainment expense and donation, is calculated as the paid-in capital of the foreign corporation multiplied by the ratio of the total assets of the Japan branch over the total assets of the foreign corporation.

There are restrictions on the tax-deductibility of directors’ remuneration.

The board members of a corporation are considered directors under the Corporation Tax Law and they are classified into two groups: directors without employee status and directors with employee status.

For tax restriction purposes, the remuneration for a director with employee status consists of both the compensation earned as a director and as an employee.

A person appointed as a branch representative in Japan of a foreign corporation is normally regarded as an employee, rather than a director, unless he is a board member of the foreign corporation.

A director's regular salary is tax-deductible unless it is in excess of the amount that the tax authorities consider reasonable. If the amount of the director's remuneration is provided for in the articles of incorporation or authorized by a resolution at a general shareholder's meeting, any amount in excess of this authorization is not deductible.

Directors’ bonuses can be deductible on condition that the corporation submits a report accordingly to tax authority in advance. However, the bonus to a director with employee status may be deductible if the bonus is paid at the same time as other employees. However, the deductible amount is limited to the amount of the bonus paid to a comparable employee.

Generally, any economic benefits given to directors are regarded as either salary or bonuses. Economic benefits include transfers of assets to directors on advantageous terms, free provision of company houses to directors, interest-free loans to directors, assumption of liabilities on behalf of directors, etc. However, fixed amounts of economic benefits paid on a monthly basis are fully deductible unless they are excessive.

Further, based on corporation tax act, in a case where the amount of directors’ remuneration is changed by a resolution of the general shareholder’s meeting held within 3 months from the beginning of the fiscal year, the total amount can be deductible.

Therefore, when the monthly remuneration is changed after the period, the amount which exceeds the original amount cannot be deductible in the fiscal year.

In Japan, group taxation regime is applied to 100% owned corporate group. 100 % ownership means that a company owns 100% shares of the other company.

Mechanism of group taxation regime regards corporations in a 100% group corporations as a single legal entity, having two significant contents; Specific transactions between corporations in the group are taken an internal transaction. And the amount of capital of a parent company is used to determine applicability of special provisions for a small corporation.

Group taxation regime is applied to 100% owned group corporations, so-called complete dominance relationship. Complete dominance relationship means direct or indirect 100% ownership of share. If shares owned by stock options and shares owned by the employee stock ownership plan are less than 5 % of the outstanding shares, those shares are exclude in determine of percentage of the ownership.

Complete dominance relationship also includes mutual relationship between subsidiaries of the parents companies, if one parent company has 100% owned relationship with other parent company.

The following provisions apply to corporations subject to Group tax regime.

When an asset is transferred between group corporations, the transfer profit or loss is deferred until the asset is transferred out of the corporate group.

Donation between group corporations is excluded of tax deductible expenses and Gift receipt profit is excluded of taxable income. This rule, however, is not applied to a corporate group which is 100% owned by an individual owner.

Total amount of the dividend from 100% owned subsidiary stocks is not included in taxable income.

In Japan, a small corporation, whose capital is 100 million YEN or less can benefit from several special provisions as below in its tax calculation.

If 100% shares of the small corporation are owned by a company, whose capital is 500 million YEN or more, the special provisions can be inapplicable for the small company.

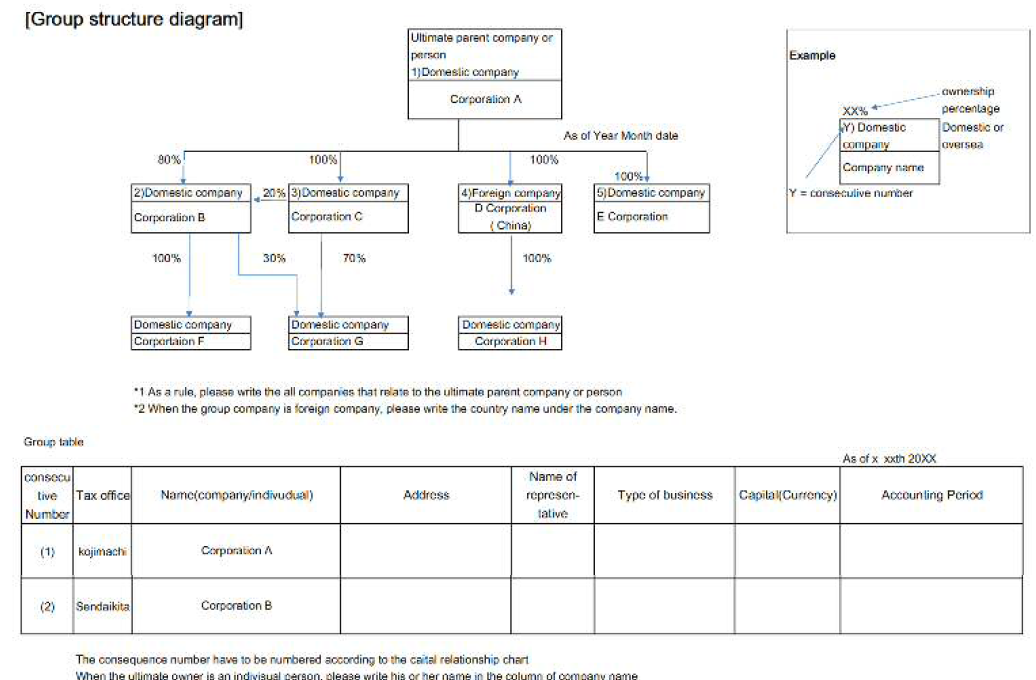

It is a requirement of a domestic company to submit its group structure diagram with the tax return where the company has 100% controlling interest in other company or the company is under control of the other, i.e. subsidiary or parent company etc. The diagram should illustrate systematically the investment relationship within the group.

It should be prepared as at the end of the fiscal year and should also include the details such as the name and address of the company, the registered tax office, the name of the representative, the type of business, the amount of capital and the accounting year end.

A separate sheet can be prepared for these details in case of large group companies and attach to the main diagram.

Below is an example of the group structure diagram;

In the case a company which invests in facilities or establishes expansion of the employment can meet certain requirements, preferential treatment shall be applied under the corporation tax law. The introduction of preferential treatment is as follows.

Blue return filing SMEs (see*2 below) operating certain businesses are qualified if the following condition is met.

(Condition)

When a company acquires the qualified investments that are capital expenditures for machines etc…, and uses for business in Japan by March 31st, 2027.

(Treatment)

The new proposal provides for 30% of special depreciation or 7% of tax credit for the acquisition cost of machinery (see *3 and *4 below).

Blue return filing SMEs (see*2 below) operating certain businesses are qualified if the following condition is met.

(Condition)

When a company acquires an equipment which contributes to the improvement of the productivity and uses it for designated businesses in Japan by March31st, 2025.

(Treatment)

The new proposal provides for 100% of immediate depreciation or 7% (see *5 below) of tax credit.

(Supplementary note)

Eligible assets should be new assets such as machinery, equipment, tools, furniture, fixtures and software that are acquired in accordance with management capability improvement plan approved by the SMEs Management Capability Enhancement Act, possessing production capacity, assets that are not for leasing out, and above certain price.

For fiscal years beginning April 1, 2024 to March 31, 2027, the salary paid to domestic employees must increase by at least 1.5% compared to the salary paid in the previous fiscal year.

Tax credit is 15% of the salary increase (see *4 below) from the previous fiscal year. (additional tax credit is available if certain conditions are met).(see *6 below)

Amounts that cannot be fully deducted in the fiscal year in which salary increases are implemented can be carried forward for five years (however, a deduction statement must be submitted to the tax office).

For the fiscal year beginning April 1, 2024 to March 31, 2027, the salary paid to employees in a continued employment must increase by 3% or more compared to the previous fiscal year.

Tax credit of 10% of the salary increase (see *4 below) from the previous fiscal year. (additional tax credit is available if certain conditions are met).(see *7 below)

For the fiscal year beginning April 1, 2024 to March 31, 2027, salary paid to employees in a continued employment (limited to generally insured persons under employment insurance) must increase by 3% or more compared to the previous fiscal year.

In principle, a tax deduction of 10% (see *4 below) of the salary increase of domestic employees from the previous fiscal year. (additional tax credit is available or if certain conditions are met. ) (see *8 below)

The following entities are required to disclose their multi-stakeholder policy and notify the relevant authorities of such disclosure;

* Legal entities with capital of 1 billion yen or more and/or capital contributions of 1 billion yen or more, and with 1,000 or more regular employees

* Legal entities with 2,000 or more regular employees

* Individual business operators with 2,000 or more regular employees as of December 31 of the applicable year

(*1) The scheme cannot be used in a fiscal year where average income over the preceding 3 fiscal years exceeds 1.5 billion yen.

(*2) SMEs for the incentives purposes are defined as corporations, whose paid-in capital is JPY 100 million or less (not owned 50% or more by a corporation whose paid-in capital is more than JPY 100 million, or two-thirds or more by corporations whose paid-in capital is more than JPY 100 million, etc.)

(*3) Companies with paid-in capital of JPY 30 million or less are qualified for tax credit

(*4) The limit is up until 20% of the corporation tax for the current fiscal year

(*5) For the company whose capital is JPY 30 million or less, it is 10%.

(*6) If the increase rate in wages is 2.5% or more, the rate is 30%.

Additionally, if the amount of education and training expenses increases by 5% or more compared to the previous fiscal year and the amount of education and training expenses is 0.05% or more of the total wages and other payments to employees, an additional 5% is added. If the company has received certification at the second level or higher under the “Kurumin” or “Eruboshi” programs, an additional 5% is added.

(*7) If the increase rate in wages is 4% or higher, the rate is 25%.

Additionally, if the amount of education and training expenses increases by 10% or more compared to the previous year and the amount of education and training expenses is 0.05% or more of the total wages and other payments to employees, an additional 5% is added.

If the company has received of “Platinum Kurumin” or certification at the third level or higher of “Eruboshi,” an additional 5% is added.

(*8) If the increase rate in wages is 4% or higher, the rate is 15%.

If the increase rate is 5% or higher, the rate is 20%. If the increase rate is 7% or higher, the rate is 25%. Additionally, if the amount of education and training expenses increases by 10% or more compared to the previous year and the amount of education and training expenses is 0.05% or more of the total wages and other payments to employees, an additional 5% is added.

If the company has received certification of “Platinum Kurumin” or “Platinum Eruboshi,” an additional 5% is added.

Related with transfer pricing taxation, “Country-by-Country Report” (CbC Report), “Master File” and “Local File” should be prepared by principally large corporation.

CbC Report and Master File should be prepared and filed by large corporation who has more than 100 billion JPY of its consolidated revenue and its group companies that are included in its consolidated financial statements.

A company who meets following condition must prepare Local File (which explains how to determine Transfer Price as Arm’s Length Price (ALP))

condition

A company having transactions with a related party that exceeded a total transaction amount in the preceding tax year of 5 billion JPY or with intangible property transactions with a related party that exceed a total transaction amount in the preceding tax year of 300 million JPY.

Local file must be prepared by corporate tax filing due date and must be kept for 7 years.

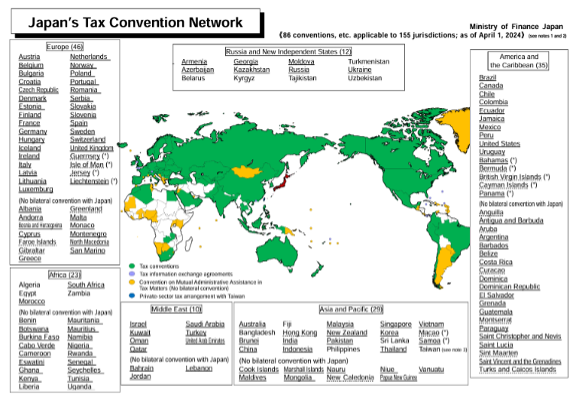

Tax treaty is “Convention between 2 countries for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income”

Tax treaty is mainly designed for prevent double taxation regarding International transactions between 2 business enterprises/individual, dividend, interest, royalty fee etc… And it is also designed for prevent international tax evasion.

The government of Japan , as of April 1st, 2024, has been made tax treaties with 155 countries (region) with 86 treaties.

Source data: Ministry of Finance Japan

https://www.mof.go.jp/english/policy/tax_policy/tax_conventions/240401EN.pdf

«86 conventions, etc. applicable to 155 jurisdictions; as of April 1, 2024»(see notes 1 and 2)

(Note 1) Since the Convention on Mutual Administrative Assistance in Tax Matters is a multilateral convention, and the tax conventions with the former Soviet Union and with the former Czechoslovakia were succeeded by more than one jurisdiction, the numbers of jurisdictions do not correspond to those of tax conventions, etc.

(Note 2) The breakdown of the numbers of conventions, etc. and jurisdictions is as follows:

・Tax convention (a convention principally for the elimination of double taxation and the prevention of tax evasion and avoidance); 73 conventions applicable to 80 jurisdictions.

・Tax information exchange agreement (a convention principally for the exchange of information regarding tax matters); 11 conventions applicable to 11 jurisdictions (These jurisdictions are marked with (*) above).

・Convention on Mutual Administrative Assistance in Tax Matters; Entered into force by 124 jurisdictions (not including Japan) (These jurisdictions are underlined above) and applicable to 142 jurisdictions due to the extension of the application of the Convention (Jurisdictions to which the Convention is extended are underlined above with dotted lines). 63 jurisdictions out of 142 do not have a bilateral convention with Japan.

・Private-sector tax arrangement with Taiwan; 1 jurisdiction

(Note 3) As for Taiwan, a framework equivalent to a tax convention is established in combination of (1) a private-sector tax arrangement between the Interchange Association (Japan) and the Association of East Asian Relations (Taiwan) and (2) Japanese domestic legislation to implement the provisions of the private-sector tax arrangement in Japan. (The two associations are now named Japan-Taiwan Exchange Association (Japan) and Taiwan-Japan Relations Association (Taiwan), respectively.)

Consumption tax is a value-added tax which is collected at several stages. It is levied on the consumption of goods and services and charged by sellers at the time of the sale of goods or the provision of services.

Periodically, sellers must total the tax collected on sales, deduct from this the tax paid on purchases and pay the balance to the tax authorities.

The result is that the consumer ultimately bears the tax, but the tax has been collected in a series of installments from each business enterprise involved in the chain of production and distribution depending on their value added. It is also designed to eliminate multiple taxation at each stage of manufacture distribution by allowing for the credit of consumption tax on purchases against that on sale.

(Note)Consumption tax on taxable purchases relating to certain residential rental buildings acquired on or after 1 October 2020 will be excluded from the tax credit.

Taxable transactions

Taxable transactions are domestic transactions and import transactions. Overseas transactions are basically out of scope.

Domestic transactions mean transfers of assets leases of assets and the provision of services which are conducted for consideration and as a business by the enterprises. Foreign cargo taken over from bonded areas is considered to be import transactions.

(Provision of electronic services from overseas)

Provision of electronic services, such as e-books or digital music etc…, from overseas companies are classified as taxable transactions. If it is provided from overseas company to domestic consumers (B to C transaction), then overseas company is liable to pay consumption tax. If it is provided from overseas company to domestic company, then domestic company is liable to pay consumption tax (reverse charge).

Tax exempt transactions

The export of goods, international transportation services, etc. are exempt from consumption tax (i.e., zero-rated). However domestic transportation charge, warehouse charge, domestic hotel charges, etc… will not be exempted even you pay to overseas.

Non-taxable transactions

Transactions which are deemed not to be properly taxable by their nature are categorized as non-taxable transactions.

There are 17 kinds of consumption tax exempt transactions, namely, sale and leasing of land, sale of securities, sale of means of payment such as money and virtual currencies, interest from deposit and loan, sale of postal stamps and gift vouchers, fees for registration and licensing paid to the government and local public bodies, foreign exchange charges, medical services under social security system, nursing care and social welfare services, educational services and certain textbooks, housing rent etc.

(Note) However, from 1 April 2020, even if the purpose of the loan is not clearly stated in the contract, the loan will be exempt from tax if it is clearly for residential use, judging from the circumstances of the loan.

Out of scope transactions

Transactions corresponding to not mentioned above are not subject to consumption tax, including tax, salary, donation, compensation for damages etc…

| Transaction by Enterprises (business owner individual and corporation) |

Domestic transactions | Transfer of assets or the provision of services |

17 items | Non taxable transactions |

|---|---|---|---|---|

| Other than above | Taxable transactions | |||

| Tax exempted | ||||

| Non transfer of assets or provision of services | Out of scope | |||

| Non-domestic transactions | Out of scope | |||

| Import transactions | Non taxable transactions | |||

| Taxable transactions | ||||

With regard to domestic transactions, business enterprises who sell taxable assets have to file consumption tax return. With regard to import transactions, business enterprises and persons (including the individual who is not an entrepreneur) who take over taxable freights from the bonded area, have to pay consumption tax return.

Business enterprises whose yearly taxable sales amount of the base period (Note 1) was equal to 10 M yen or less 10 M yen, then they become tax-exempt enterprise.

Business enterprises whose yearly taxable sales amount of the base period (Note 1) was equal to 10 M yen or less 10 M yen, then they become tax-exempt enterprise.

(Note 1) The two fiscal years before that year

(Note 2) Even if the taxable sales for the base period are 10M or less, if the taxable sales for the specific period (Note 3) exceed 10 million yen, the business will be a taxable business for consumption tax. (Instead of the taxable sales for the specific period, the total amount of salary and other payments for the same period can also be used for the determination (Note 4))

(Note 3) In the case of corporations, this generally refers to the first six-month period of the previous business year.

(Note 4) For overseas businesses, the determination based on the total amount of salary and other payments cannot be applied from tax periods beginning on or after October 1, 2024.

Start-up enterprises are exempt from consumption tax during their first and second business years, because no taxable sales occur for the relevant base periods. The enterprise, however, is not exempt from tax during its first and second business years, if its paid-in capital is \10 million or more at the beginning of the business year. But they may become tax payer from 3rd business year if the first year’s taxable sales exceed 10M yen. (Note 5, 6)

(Note 5) From fiscal years beginning on or after October 1, 2024, corporations with domestic taxable sales of more than 500 million yen or worldwide revenues of more than 5 billion yen and established with capital of less than 10 million yen will not be exempt from tax obligations even for tax periods without a base period.

(Note 6) From fiscal years beginning on or after October 1, 2024, overseas businesses with capital of 10 million yen or more at the time of starting business in Japan will not be exempt from tax obligations even for tax periods with a base period.

The consumption tax rate is 10% (national tax 7.8%, local tax 2.2%).

A reduced tax rate 8% (6.24% for national tax and 1.76% for local tax) applies to food and beverage products (excluding alcoholic beverages and food service) and to newspapers published more than twice a week (based on subscription contracts).

Basic formula of tax calculation is as follows:

[Tax due]= [Consumption tax on sales] – [Consumption tax on purchase]

Taxable sales amount is total amount of taxable sales transactions in Japan and Export tax exempt transaction. Taxable purchase amount is total amount of taxable purchase in Japan and taxable import goods removed from a bonded area. There are 2 tax system for computation of consumption tax on purchase to be credited from consumption tax on sales (Purchase tax credit), Basic tax system and Simplified tax system.

In basic method, taxable sales ratio is applied for computation of purchase tax credit.

Taxable sales ratio = TAXABLE SALES amount / SALES amount

TAXABLE SALES amount is the total amount of transfer of taxable assets in Japan plus Export sales. SALES amount is the total amount of transfer of taxable assets in Japan plus Export sales plus Non-tax transaction.

If taxable sales ratio is 95% or more, and also annual taxable sales amount is less than ¥500M, full amount of consumption tax on purchase can be credited. If it is less than 95% or annual taxable sales amount is over ¥500M, purchase tax credit is calculated by either Itemized method or Proportional method.

| Purchase tax credit | Taxable sales ratio is equal or more than 95%, and Annual taxable sales is less than 500M JPY |

100% credit | Taxable sales ratio is less than 95%, or Annual taxable sales is over 500M JPY |

Itemized method (A) |

| Proportional method (B) |

(A) Itemized method: Expenses are categorized in three groups: expenses corresponding only to [①Consumption tax corresponding to taxable sales ], [②Consumption tax corresponding to non-taxable sales ], and [➂Consumption tax corresponding to both taxable and non-taxable sales ]. Purchase tax credit is calculated as below:

① +(③x[Taxable sales ratio])

(B) Proportional method: Purchase tax credit is calculated as below

(①+②+③)x[Taxable sales ratio]

Once a company selects to use Proportional method, it is required to apply this method continuously for 2 years. It is necessary to consider which method would be more advantageous for at least two years. Company which calculates purchase tax credit by using Itemized method, may select to apply the Proportional method in the next year.

Preservation of both books recording the facts of payment of expenses and invoices or receipts as evidence is indispensable to have tax purchase credit in preparation of consumption tax return.

Company is required to book consumption tax amount by each different tax rate (10% and 8%), along with original purchase invoices (separate invoice storage method).

From October 2023, Invoice method will begin in which every company is required to have company number on each invoice. (Please refer 1-6) Qualified invoice-based method )

1-6-a) Registration as the issuer of qualified invoice

With implementation of the qualified invoice-based method (Invoice system), only the operator registered as the issuer of qualified invoice (Registered operator) can issue the qualified invoice.

The operator to be registered need to submit the application of registration. If the operator would like to be registered as of 1st October 2023, the operator has to submit the application by 30th September 2023. After the submission the tax office will inform the operator its registration number and the registration number will be released on National Tax Agency’s publication site.

1-6-b) Qualified Invoice / Existing invoice (current system)

A qualified invoice is a document by which a seller informs a buyer the applied rate of consumption tax and the amount of consumption tax and the buyer does its accounting process based on it.

Items to be mentioned in an existing invoice (current system) until 30 September 2023

|

① Name of operator ② Date/month//year of transaction ③ Content of transaction (clarify reduced rate 8% item) ④ Total amount of price including consumption tax, sorted by tax rate (Basic rate 10% and reduced rate 8%) ⑤ Name of recipient of Invoice |

Additional items to be mentioned in the Qualified invoice from 1 October 2023

|

⑥ Registration Number of registered operator ⑦ Applied tax rate (10% and 8%) ⑧ Amount of consumption tax , separately calculated by tax rate 10% and 8% |

1-6-c) Issuance and retention of the qualified invoice

In the Invoice System, the seller and the buyer have to do below respectively.

The registered operator as a seller has to issue the buyer a qualified invoice upon request and save the copy of the issued invoice for 7 years.

The buyer has to keep the qualified invoice issued by the registered operator to be applied of deduction of consumption tax credit.

1-6-d) Non-taxpayer

A company or an individual business person exempted from an obligation of filing consumption tax return ( Non-taxpayer) can’t register as an registered operator and can’t issue an qualified invoice. Therefore when the buyer receives the invoice issued by Non-taxpayer, the buyer can’t deduct the consumption tax paid to the Non-taxpayer in the calculation of consumption tax return. (There is a Transitional period for 6 years. Please refer 1-6-e)) If Non-taxpayer wants to register as an registered operator , the Non-taxpayer has to become Tax payer .

1-6-e) Transitional measures

With the implementation of the invoice system, assuming the increase of the tax burden for Non-taxpayer by becoming the taxpayer, and the increase of administrative burden related with the retention obligation of the invoices, the below transitional measures are applied.

| Item | Overview | Applicable operator | Applicable period |

|---|---|---|---|

| Tax credit for the purchase from nontaxpayer | 80% or 50% tax credit can be applied to the purchase from the non-taxpayer | Tax-payer (Buyer) | Purchase between 2023/10/1-2026/9/30: 80% Purchase between 2026/10/1-2029/9/30: 50% |

| Special measure for small-sized operator (20%-Special measure) | 20% of the base amount of the taxable period can be regarded as the tax payable of the taxable period | Non-taxpayer (Seller) which becomes the tax-payer by registration as the qualified invoice issuer (For tax periods beginning on or after October 1, 2024, overseas businesses that do not have a permanent establishment on the first day of that tax period will not be able to apply the simplified taxation system.) |

Taxable period to which any date between 2023/10/1 to 2026/9/30 belongs. |

| Exemption of retention obligation of small-amount invoice | Regarding the purchase less than JPY10,000, the tax credit can be applied only by keeping the accounting book with certain related description and the retention of the related invoice is not necessary. | Tax-payer (Buyer) with the base period’s taxable sales not exceeding JPY100M or the special period’s taxable sales not exceeding JPY50M | Purchase between 2023/10/1- 2029/9/30 |

※The above transitional measures are reflects the law as of 1st April 2024.

If taxable sales of an enterprise in the base period is ¥50million or less and Notification of selecting simplified system has been filed to tax office before the date of beginning of the taxable year, the enterprise calculate purchase tax credit by applying a certain rate of sales turnover.

(For tax periods beginning on or after October 1, 2024, overseas businesses that do not have a permanent establishment on the first day of that tax period will not be able to apply the simplified taxation system.)

| Type of Business | rate |

|---|---|

| Wholesales | 90% |

| Retailers | 80% |

| Manufactures, Constructors, Agricultures | 70% |

| Restaurants(Eating and drinking industry), Business that are not included in others | 60% |

| Financial Services, Insurance, Transportations and Service Industries(except restaurants) | 50% |

| Real Estates | 40% |

A corporation running only one type of business can calculate purchase tax credit by multiplying taxable sales amount by corresponding sales turnover ratio. In the case a corporation runs more than two types of business, taxable sales need to be classified by types of business. If no classification given, the corporation has to apply the lowest ratio of sales turnover to calculate its purchase tax credit. The corporation, therefore, can take advantage in tax calculation by knowing exact types of business it runs and classifying its transactions accordingly.

A corporation running only one type of business can calculate purchase tax credit by multiplying taxable sales amount by corresponding sales turnover ratio. In the case a corporation runs more than two types of business, taxable sales need to be classified by types of business. If no classification given, the corporation has to apply the lowest ratio of sales turnover to calculate its purchase tax credit. The corporation, therefore, can take advantage in tax calculation by knowing exact types of business it runs and classifying its transactions accordingly.

The tax period for a corporation is its financial year. However, they can also use quarterly or monthly tax periods

A corporation whose previous year's tax due exceeded ¥480,000 must file and pay provisional tax at 50% of the consumption tax reported on the final tax return of the previous tax period within two months of after the first six months past in the tax year.

If the previous year’s tax due exceeded ¥4,000,000, quarterly filing and payment are required. If the previous year's tax due exceeded ¥48,000,000, a corporation must file and pay tax at 1/12 of previous year’s tax.

If the amount of tax paid on purchase exceeds the tax received on sales on the date of tax period closing, the excess is refunded after the final tax return is filed with the tax office.

If a corporation makes provisional settlement of accounts of consumption tax, the corporation is allowed to file interim return of consumption tax and make payment of the tax by using the amounts of the provisional settlement of accounts, instead of using the previous year’s result. In the case that the corporation have profit in the previous financial year and has the burden of payable interim consumption tax calculated by the result of the previous year. Even if the amount figured out by provisional settlements of account is negative, the corporation can receive no refund of tax.

In the case the corporation made the interim payment of consumption tax, the sum of the interim payment is credited from annual tax amount.

With regard to the import of taxable goods, an individual or a corporation who take over the goods from bonded area submits import declaration to chief customs inspector and pay the consumption tax on the goods. The amount of the consumption tax on the goods is included in calculation of purchase tax credit mentioned in 8-5) above.

Fixed assets tax and City planning tax are imposed when the company or individual have real estates, or depreciable property.

| Object of taxation | Land / Building | Depreciable asset (*1) |

|---|---|---|

| Taxpayer | Individual or company who is registered as its owner as of January 1st at the legal affairs bureau. | Individual business owner or company who have depreciable asset for business use as of January 1st. |

| Taxable minimum | Land ¥300,000, Building ¥200,000 | ¥1.5M |

| Tax rate | 1.4% + City planning tax (under 0.3%) | 1.4% |

| Base of taxation (課税標準) |

Valuation amount by each municipality | Book value by declining value method |

| Due date of filing | Not necessary for filing tax return | January 31st |

| Tax due date | Annual amount is to be paid in 4 installments in Apr., July, Dec., Feb.. | |

| Note | There are some tax reduction measures for residence | Fixed assets 3 years equal depreciation is applied are not taxable. |

*1. If the small or medium sized company newly invests to a certain kind of machineries, equipment or building’s accompanying facilities based on the plan which is approved by the city in advance regarding plans of Advanced Equipment, then the taxable base amount of depreciable assets tax levied by the city will be reduced to 1/2-1/3 of the original taxable base amount for 3-5 years. In this case, the machines or the equipment, or the building’s accompanying facilities must be newly purchased by March 31st,2025.

Some municipalities with population of 0.3M or more impose office tax on a company or individual business owner whose office is over 1000 ㎡, or have over 100 employees.

| Tax amount | Per floor space tax : ¥600/㎡ Per number of employee tax :Total annual salary×0.25% |

|---|---|

| Due date of filing | Company: Within two months of the end of the fiscal year. Individual business owner : March 15 |

| Tax due date | Same as tax filing. |

Anyone who purchase Real-estate (land, building) is liable to pay this tax. (It does not matter whether purchase transaction is registered or not.)

| Taxable amount: | The amount which evaluated by the city in order to levy property tax | |

|---|---|---|

| Tax rate: | 4% | |

| Tax exemption amount: | Land | 100,000 yen |

| Building | 230,000 yen per one, 120,000 for additional one | |

| Non taxable transactions: | Inhelitance, Marger of Split of company | |

Individuals with employment income are subject to income tax. Employment income includes salaries, wages, director’s remuneration, bonuses and other compensation of a similar nature. Benefit in kind provided by the employer, including the private use of an employment-provided automobile, permanent company housing, tuition for dependent children, life insurance premiums, private medical insurance premiums and private pension contributions, are included in employment income. However, certain employer-paid benefits, including commuting allowance to a certain limit, moving expenses, loans interest above market rate and, for resident foreigners and nonresidents, home-leave expenses(until a predetermined number of times), are excluded from taxable income.

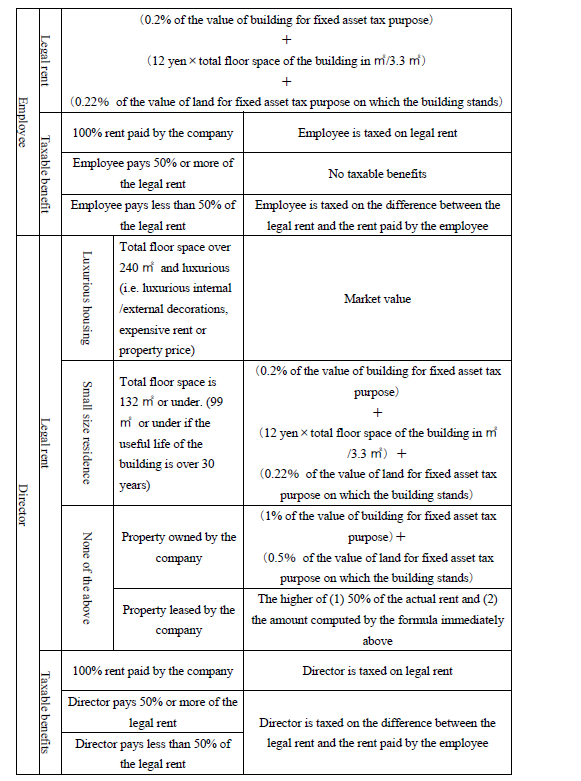

Regarding company housing, when an employer collects “Taxable value of company provided housing (i.e. legal rents)” from directors and employees, they are treated as not being provided any taxable benefits by the employer. Please see the following page for how this “Taxable value of company provided housing” is calculated.

| Gross Receipts | Amount of employment Income deduction (¥) | |

|---|---|---|

| Exceeding | Not exceeding | |

| 0 | 1,900,000 | 650,000 |

| 1,900,000 | 3,600,000 | Gross salary x 30% + 80,000 |

| 3,600,000 | 6,600,000 | Gross salary x 20% + 440,000 |

| 6,600,000 | 8,500,000 | Gross salary × 10% + 1,100,000 |

| 8,500,000 | 1,950,000 (upper limit) | |

*Although the above table is applied to individual income tax from 2025, the actual deduction of withholding tax from monthly salary in 2025 is made based on the table before revision and the difference is solved by procedure of 2025 year-end adjustment.

When a director or an employee is using company provided housing and if the company is not deducting legal rent from the individual, it will be treated as a benefit in kind for the tax purpose. Therefore, normally the amount equivalent to the legal rent is deducted from the salary. The legal rent is calculated as below, based on floor space and taxable value of fixed asset tax for land and building.

Director’s remuneration paid by a Japanese corporation to a nonresident is considered Japanese-source income and is subject to tax in Japan, even if the services are performed outside Japan

If employees’ actual expense during a year exceeds 50% of standard employment income deduction (see Deduction for Employment Income , Page 27), the excess may be deducted in addition to the employment income deduction. Specially allowed expenditures include commuting expenses, moving expenses for a company transfer, (travel expense, hotel accommodation and delivery expense of baggage), training expenses for technological skills or certain qualification directly required in the performance of duties, and expenses for books, clothes and entertainment.

Expenses for books, clothes and entertainment that are directly related to work is called “Necessary expense for work”, maximum of which is ¥650,000.

Expenditures must be documented and certified by the employer. The deduction of specific expenditures may be claimed only by filing a tax return.

Social insurance premiums are fully deductible.

Life insurance, nursing/medical-care and individual pension premiums are deductible up to a maximum ¥120,000. (For nursing medical care insurance, only those contracted in or after 2012 are applicable.)

For casualty insurance premiums, the deductible amount is ¥50,000 for earthquake insurance premiums and ¥15,000 for former long-term casualty insurance. The deductible amount of combined earthquake and former long-term casualty insurance premiums may not exceed ¥50,000.

Personal exemptions are available for purposes of income tax and inhabitant tax. The following table outlines personal exemptions. (Note 1)

| Type (outline) | Tax deduction for national tax | Amount for inhabitant tax |

|---|---|---|

| Basic exemption | Income /Exemptio Equal or less than ¥1,320,000 / ¥950,000 ¥1,320,000~¥3,360,000 /¥880,000(Note2) ¥3,360,000~¥4,890,000/¥680,000(Note2) ¥4,890,000~¥6,550,000/¥630,000(Note2) ¥6,550,000~¥23,500,0000/¥580,000 ¥23,500,000~¥24,000,000/¥480,000 ¥24,000,000~¥24,500,000/¥320,000 ¥24,500,000~¥25,000,000/¥160,000 Over ¥25,000,000 /¥0 |

¥430,000 In case the person’s income is over JPY24,000,000, JPY0 – 290,000 |

| Exemption for spouse (Note 3) |

¥380,000, ¥260,000, or ¥130,000 depends on income level of tax payer (If the age of spouse equal or exceed 70 year’s old, Amount of exemption become ¥480,000, ¥320,000 or ¥160,000) |

¥330,000, ¥220,000 or ¥110,000 depends on income level of tax payer (If the age of spouse equal or exceed 70 year’s old, Amount of exemption become ¥380,000, ¥260,000 or ¥130,000) |

| Special exemption for spouse (Note 3) |

¥10,000 - ¥380,000 depends on income level of tax payer’s and his/her spouse |

¥10,000 - ¥330,000 depends on income level of tax payer’s and his/her spouse |

| Exemption for dependents | ||

| Younger than 16 years old | 0 | 0 |

| 16 - 19 years old | ¥380,000 | ¥330,000 |

| 19 - 23 years old | ¥30,000-¥630,000 Depending on dependent’s income |

¥30,000-¥450,000 Depending on dependent’s income |

| 23 - 70 years old(Note3) | ¥380,000 | ¥330,000 |

| 70 years old or older | ¥480,000 | ¥380,000 |

(Note 1) If a resident who receives salary etc. applies for the above allowance for non-resident dependents, they are required to submit or present “Documents concerning relatives” or “Documents concerning remittances” or both to the payer of the salary when paid or at annual year-end tax adjustment. Those who file personal tax returns need to submit or present the above document(s) to the tax authority with the tax return if they have not already submitted or presented them to the payer of the salary.

(Note 2) From 2027 onward Exemption amount will be 580,000 yen.

(Note 3) You can not get both exemptions (“Exemption for spouse” and “Special exemption for spouse”) at the same year. If the tax payer’s annual income exceeds 10M yen, then the tax payer can get neither of them.

(Note 4) From 2023 onward, exemption of dependents will not applied to dependent who lives overseas and between equal or more than 30 years old and less than 70 years old, except certain people such as overseas student and person with disability.

Salaries paid to residents are subject to income tax withholding at the source.

The amount to be withheld may be determined using the “Tax Withholding Table” provided as an attachment to the Income Tax Law according to the nature of the salary, the period of payment, and the number of dependents the income earner has. However, nonresidents are generally subject to withholding of 20.42% of income tax irrespective of the amount of the salary and the number of dependents (refer to the following table).

In order to withhold income tax properly, salary recipients must submit to the tax authorities, through their employer, "a statement concerning exemptions for dependents, etc." giving the names of dependents and other necessary particulars.

For salaries paid monthly, the tax amount is obtained from the "Monthly Table" according to the amount of salary paid and the number of dependents.

| Monthly salary amount after deduction of social insurance premiums | Number of dependents | |||||

|---|---|---|---|---|---|---|

| Over(¥) | But not over(¥) | 0 | 1 | 2 | 3 | 4 |

| Amount of tax(¥) | ||||||

| : | : | : | : | : | : | : |

| 335,000 | 338,000 | 11,360 | 8,210 | 6,600 | 4,980 | 3,360 |

| 338,000 | 341,000 | 11,610 | 8,370 | 6,720 | 5,110 | 3,480 |

| 341,000 | 344,000 | 11,850 | 8,620 | 6,840 | 5,230 | 3,600 |

| 344,000 | 347,000 | 12,100 | 8,860 | 6,960 | 5,350 | 3,730 |

| : | : | : | : | : | : | : |

Computation of tax withheld from a salary paid monthly (example)

<Assumption>

* Resident taxpayer, non-director, age: before 40 years old,

married with two children (both children are age 16 or more)

* Monthly salary amount before deduction of income tax and social insurance premiums is ¥400,000

* Commutation allowance is ¥20,000

* Social insurance premiums refer to the rate (see chart 9-2)

* Health insurance ¥20,992, social security pension ¥37,515, employment insurance ¥2,310

<Computation for withholding income tax>

The amount of salary after deduction of social insurance premiums is

¥400,000 –¥20,992 - ¥37,515 - ¥2,310 = ¥339,183

Referring to the table of withholding from employment income above, ¥339,183 and 3 dependents cross. As a result, withholding tax is ¥5,110.

| Payment | *Deduction | |||

|---|---|---|---|---|

| Salary | 400,000 | Health insurance | 20,992 | |

| Transportation | 20,000 | Welfare pension insurance | 37,515 | |

| Unemployment insurance | 2,310 | |||

| Withholding income tax | 5,110 | |||

| Net payment | ||||

| Sum | 420,000 | Sum | 65,927 | 354,073 |

*The inhabitant tax is also deductible. The annual amount of the inhabitant tax is computed by multiplying the tax rate referred to 5) below. By a one-twelfth of the inhabitant tax is deducted from a salary every month from June in the next year to May in the year after next. The inhabitant tax deducted is paid to municipality by a company.

In the example above, the each burden of social insurance for employer /employee is as follows.

| Employer | Employee | |

|---|---|---|

| Health insurance | 20,992(51.20/1,000) | 20,992(51.20/1,000) |

| Welfare pension insurance | 37,515(91.50/1,000) | 37,515(91.50/1,000) |

| Unemployment insurance | 3,780(9.0/1,000) | 2,310(5.50/1,000) |

| Workmen's compensation insurance | 1,260(3.0/1,000) | None |

| Total amount | 63,547(154.70/1,000) | 60,817(148.20/1,000) |

Individual income taxes consist of national income tax and local inhabitant tax.

Individuals are also subject to a local enterprise tax on income derived from business at rates ranging from 3% to 5%.

Normally, a 20.42% withholding tax is levied on nonresidents, with no deductions available; however, depending on the type of income, tax may be levied at progressive rates through self-assessment (refer to 3-8). Dividends paid by Japanese companies, interest income, annuities and prizes are also subject to a withholding tax if paid to nonresidents.

National income tax rates are progressive. The rates range from 5% (on taxable income of up to ¥1.95 million) to 45% (on taxable income exceeding ¥18 million), as shown in the following table. (*)

| Taxable income | Tax on lower amount(¥) | Rate on excess(%) | |

|---|---|---|---|

| Exceeding(¥) | Not exceeding(¥) | ||

| 1,950,000 | 0 | 5 | |

| 1,950,000 | 3,300,000 | 97,500 | 10 |

| 3,300,000 | 6,950,000 | 427,500 | 20 |

| 6,950,000 | 9,000,000 | 636,000 | 23 |

| 9,000,000 | 18,000,000 | 1,536,000 | 33 |

| 18,000,000 | 40,000,000 | 2,796,000 | 40 |

| 40,000,000 | 4,796,000 | 45 | |

(*) An extra amount of 2.1% of income tax levied will be imposed as Special Reconstruction Income Tax until 2037.

Local inhabitant taxes, both prefectural and municipal, consist of per capita and income levies. The amount of per capita tax is ¥4,000 per year per person (¥1,000 for prefectural and ¥3,000 for municipal). The percentage of per income levy is 10% (4% for prefectural and 6% for municipal). Per-capita tax is around 5,000 yen annually (*1). Non-residents are not subject to local inhabitant tax.

(*1)A person who lives in Osaka city, per-capita tax is 5,300 yen (prefecture tax 1,300 yen + city tax 3,000 yen + forest environmental tax 1,000 yen). A person who lives in Tokyo, per-capita tax is 5,000 yen (metropolitan tax 1,000 yen + city tax 3,000 yen + forest environmental tax 1,000 yen)

(Note) The Forest Environmental Tax is a national tax that will be levied on individuals who reside in Japan from fiscal year 2024. Municipalities will collect 1,000 yen per person per year in addition to the individual resident tax per capita.

Individual income taxation in Japan is based on the self-assessment principle. In general, taxpayers must file tax returns to declare income and deductions and to pay the tax due. However, the national income tax liability of individuals compensated in yen at gross annual amounts not exceeding ¥20 million is settled through employer withholding if income other than main income source does not exceed ¥200,000. For a nonresident, if tax is withheld from payments and the amount withheld satisfies the liability, income tax return does not need to be filed. Married persons are taxed separately, not jointly, on all types of income.

Income tax returns must be filed, and the final tax paid, between February 16 and March 15 (Note) for income accrued during the previous calendar year. For those taxpayers who filed tax returns for the preceding year and who reported tax liabilities of ¥150,000 or more after withholding, prepayment of income tax for the current year is due on 31 July and 30 November. Each prepayment normally equals one-third of the previous year’s total tax liability, less amounts withheld at the source. If prepaid and withheld payments exceed the total tax due, they are refundable if a return is filed.

(Note) Tax return claiming refund can be filed before February 16.

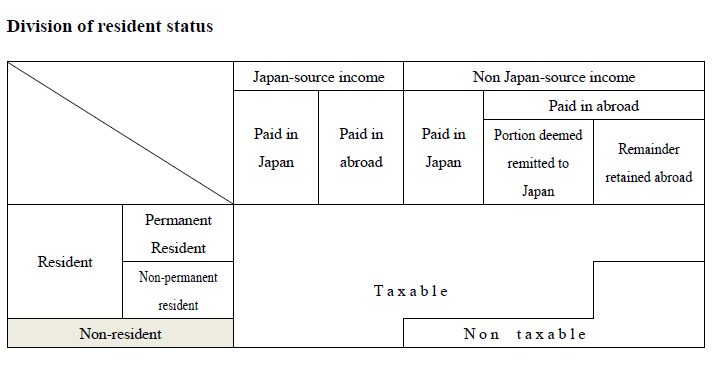

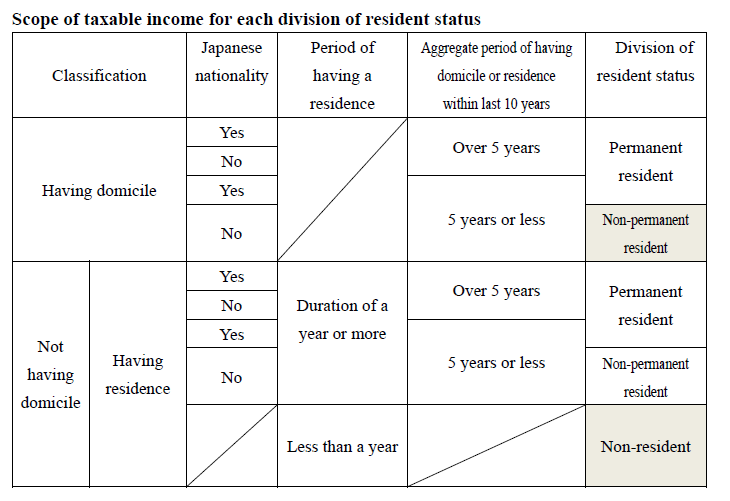

An individual's tax status governs the types of income that are subject to national income tax and local inhabitants’ tax as well as deductions and tax rates.

A nonresident taxpayer (an individual other than the resident who has a domicile or owns a residence continuously for more than one year) is subject to Japanese income tax on Japan-source income regardless of where it is paid.

Most tax treaties, however, provide for an exemption from Japanese tax on employment income of a nonresident taxpayer present in Japan for 183 days or less during a calendar year, if certain other conditions are satisfied. One has to prepare a certain application and submit it to the tax office in order to obtain a tax exemption.

An individual of non-Japanese nationality having a domicile or residence in Japan for an aggregate period of five years or less within the last ten years is further classified as a nonpermanent resident taxpayer. A nonpermanent resident taxpayer is subject to income tax on Japan-source income plus that part of non-Japan source income that is paid in and/or remitted to Japan.

Non-Japanese individuals who are neither nonresidents nor nonpermanent residents are classified as permanent residents.

A permanent resident taxpayer is subject to Japanese income taxes on his or her worldwide income. If he or she has to pay double taxes to different countries, he or she may be allowed a tax deduction.

In a broad sense, social insurance includes Health insurance, Nursing care insurance, Welfare pension insurance, Unemployment insurance and Labor accident insurance.

Social insurance programs in Japan include health insurance, nursing care insurance, welfare pension insurance. Health insurance covers medical care expenses for employees and their dependents in the case of disease, injury and delivery. The nursing care insurance is the system that covers the care of care recipients from the budget of insurance premium. Welfare pension members would receive an extra benefit besides their basic pension of the national pension system when they become elderly and in case they get handicapped. When they pass away, their spouses or children under the age of 20 would be able to receive their pension.

Full-time employees and employed directors should join Health Insurance and Welfare Pension. Contract employees or part-time workers, whose working hours exceed 3/4 of that of full-time employees should also join the systems.

(Employer who is hiring more than 500 employees may need to let all part-time employees into social insurance system even their work hours are below 3/4 of full-time employees.)

Every person who is 40years old or more and less than 65 years old need to enter the Nursing care insurance which is part of health insurance.

The premiums are borne equally by employers and employees. Employers withhold the part borne by employees from their salary and bonus, and employers make total premiums payment at the end of the following month

Employment Insurance is a system to help stabilize the life of employees in the case of unemployment and help them to find the next job.

Accident Compensation Insurance covers the injuries during commuting and working, and disease or death due to work, under the system, compensation is made to employees or their family.

As a rule, all employees should join Employment Insurance. The system is also compulsory for short-time workers like contract employees and part-timers if they are expected to be in employment for equal or more than 31 days and if they work for equal or more than 20 hours a week.